Roofing Insurance Claims in Houston, TX

Understanding Roof Damage & Insurance Coverage in Houston

As a Houston homeowner, understanding your roofing insurance coverage is crucial due to the frequent severe weather events like hurricanes and hailstorms. These occurrences can significantly impact roof integrity and lead to claims. Familiarize yourself with your policy’s specifics, including what types of damage are covered and any deductibles or exclusions. This knowledge is essential in preparing for the claims process and ensuring complete protection under your policy.

Most people, when working with their insurance company to have their roof replaced, get very confused. The confusion arises because most of the time the insurance company will issue you two separate checks for your roof replacement. Not understanding that they will receive two checks, most homeowners panic when they receive their first check and think, “This is ALL the insurance company is paying to have the roof redone?”

Understanding roofing insurance claims can be particularly challenging in regions like Houston and Texas due to the frequent occurrence of severe weather conditions. Hurricanes and hailstorms are common, which means that roofs are often subject to significant wear and tear. It’s important for homeowners to be proactive in understanding their insurance policies and claims process to ensure comprehensive coverage. This awareness not only helps in easing the claims process but also ensures homeowners are adequately compensated for the damage sustained.

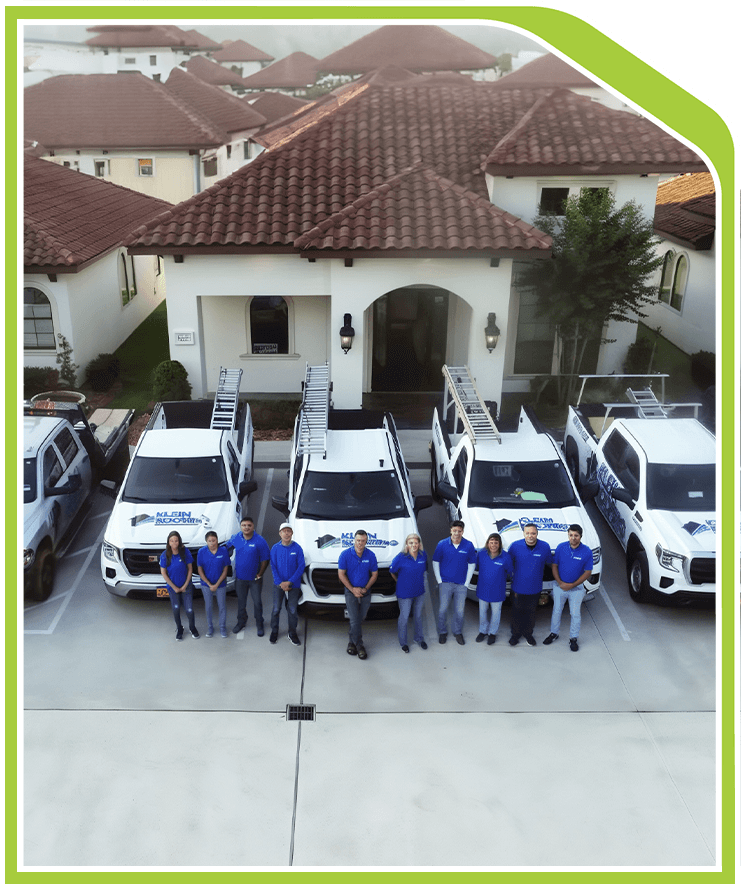

Need roofing insurance claim in Houston, TX? Call Klein Roofing at (888) 828-5630 or send us a message online today!

How Will the Insurance Process Work for Roofing Insurance Claims in Houston?

No need to fear! Here is an explanation, in easy-to-understand terms, of how most roofing claims proceed with the insurance company involved. The six steps will cover everything you'll need to know about the roof insurance claims process in Houston.

Step 1 - Call in Your Claim for Roofing Insurance

The first step is for you, the homeowner, to call your claims department and file a claim. REMEMBER – this page explains the process that will occur when you get your insurance company involved. Before you ever call your claims department, you should always have your roof checked by a trustworthy roofer. If you think you have hail damage and don’t have your roof inspected, but call your claims department instead, you have just filed a claim on your roof. The insurance company is not there to inspect your roof for damage for you. They’re there to verify damage that you have.

When you call your claims department, you’re filing a claim whether you have damage or not. To call in a claim, you can either call your local agent and ask for help or call your claims department directly. You will be asked questions like: “What kind of damage do you have?” “When did the damage happen?” and many other questions. If you don’t know the answers to the questions, just tell the service rep.

Once the service rep has taken all your information, they will assign the claim to an adjuster, which leads to Step 2 in the roofing insurance claims near me process.

Licensed & Certified

Step 2 – Scheduling with the Adjuster for Roofing Claims

The insurance company’s claims adjuster will call you and tell you when they will come to inspect your roof. You don’t have to be there for this unless you want to be; however, it is a good idea to let your roofer know (if you already have a roofer selected) when that inspection will occur. Most roofers like to be there when the adjuster arrives.

Having your roofer present during the adjuster’s evaluation can be invaluable. The roofer can provide insights and clarification regarding the extent of the damage, potentially influencing the adjuster’s assessment positively. This collaboration often results in a more accurate estimation of the damages and ensures that all roof-related issues are documented and considered in the claim. It empowers homeowners by bridging the communication between contractors and insurance providers, fostering a more transparent claims process.

Step 3 – Receiving the Estimate Letter & Check

If the adjuster believes that you have damage on your roof, they will write an estimate for the scope of the work to be done. They may be able to print that estimate letter in their car, but most of the time, that letter will be mailed to you. The adjuster may also have the ability to write you a check on the spot, too. But, again, most of the time, that check will come in the mail with the estimate letter. The estimate letter shows, in line-by-line detail, everything that the adjuster is putting in the claim. In addition to the roof, it may include gutters, furnace vents, painting, windows and screens, and even fences.

Read Why our customers love us

Our Reviews

-

This company was so friendly and helpful!- Julie D.

-

If you need a new roof, Klein Roofing is the company to call. They were professional, respectful, and had great prices.- Michelle R.

-

They left my roof looking better than it did 20 years ago when I first got the house!- Helen D.

-

I will be recommending these guys to all my friends and family.- Ryan L.

Final Steps in Your Roofing Insurance Claims Process

Step 5 – Getting the Work Done on Your Roof

Once you have your estimate letter and first check, your roofing contractor can get started on doing the work of replacing your roof. If they also subcontract the other work, such as gutters, vents, or other items, they’ll take care of those things at around the same time. If the roofer does not handle the "peripheral" work, then you will need to find contractors that do those other things.

If you’re needing to find contractors to do other work that is in the insurance estimate, make sure that your roofer does not collect all of your insurance money. Make sure to hold back the money needed to complete that other work.

Step 6 – Completion of Work & Final Insurance Check

Once your roofer has completed the work, they will send a final invoice to the insurance company stating that the work is complete and showing their costs for the project. The insurance company will then release the depreciation (if applicable – see notes on Step 4 above) to you and you’ll receive your second check.

Ensuring all aspects of the roofing project are thoroughly documented and reviewed is crucial for a smooth process. Before the final invoice is submitted, verify that the roofing contractor has completed all tasks as agreed upon in the insurance estimate. This step is essential in confirming that no details have been overlooked and that the completion aligns with both the insurance requirements and your expectations, paving the way for the final financial reconciliation.

Understanding Houston's Roofing Regulations & Compliance

In Houston, specific regulations and building codes govern roofing repairs and installations. It's essential to be aware of these requirements to ensure that any work conducted on your property complies with local standards. These codes are designed to enhance safety and durability, considering the region's susceptibility to extreme weather events. Consulting with a professional roofer familiar with Houston's building codes ensures that your project adheres to all legal requirements, avoiding potential fines or delays in claim processing.

Role of Public Adjusters in Roofing Insurance Claims in Houston

Public adjusters can play a pivotal role in the claims process for homeowners in Houston. These licensed professionals help policyholders navigate the complexities of insurance claims, particularly in assessing and negotiating with the insurance company for a fair settlement. Engaging a public adjuster can be beneficial when dealing with large claims or if there's a dispute over the insurance provider's estimate. They work on behalf of the homeowner, providing an added layer of assurance, especially when unfamiliar with the intricacies of the claims process.

Frequently Asked Questions About Roofing Insurance Claim

How Do I Prepare for a Roofing Insurance Claim in Houston?

Preparing for a roofing insurance claim involves several critical steps. First, document all visible damage with photos and videos as soon as it's safe to do so. Keep records of weather reports that correspond with the date and location of the damage, which helps establish the timing and cause of roof damage. Ensure that you review your insurance policy thoroughly to understand what is covered and what is excluded. It's also advisable to contact a reputable local roofer to conduct an initial inspection and provide an estimate. Being organized with documentation and having a clear understanding of your policy will streamline the claims process and enhance the likelihood of a favorable outcome.

What Are the Common Pitfalls in Roofing Insurance Claims?

Several pitfalls can affect the success of a roofing insurance claim. One common issue is failing to provide comprehensive documentation for the damage sustained. Without sufficient photographic evidence and detailed descriptions, claims can be denied or undervalued. Another challenge arises when homeowners delay filing a claim, which can lead to questions about the timeline of the damage. Misunderstanding policy details, such as deductible amounts or coverage limits, often leads to financial surprises, emphasizing the need for policy review ahead of filing. It's also important to avoid accepting the first estimate without scrutiny, as this amount may not cover the full extent of the necessary repairs.

Can Severe Weather Affect My Claim in Houston?

Yes, severe weather events in Houston can significantly affect roofing insurance claims. After major storms, insurance companies may be inundated with claims, possibly delaying response times. However, these conditions also provide documented justification for the claim, as severe weather is a primary cause of roof damage. Responding promptly by filing a claim and securing interim measures, such as tarping the roof to prevent further damage, is crucial. Working with local professionals who understand the specific challenges posed by Houston's climate can facilitate smoother claims processing and settlement.

Is It Beneficial to Have My Roofer Present During Inspection?

Having your roofer present during the insurance adjuster's inspection can be highly beneficial. The roofer can highlight areas of concern that might be overlooked, ensuring that all damages are acknowledged and recorded in the adjuster's report. This involvement can result in a more accurate and comprehensive claim evaluation. The presence of a knowledgeable contractor aids in clear communication, aligning the adjuster's findings with the practicalities and nuances of roofing work. This teamwork can lead to a more complete assessment and a higher likelihood of receiving adequate claim coverage.

How Long Does the Roofing Insurance Claim Process Take in Houston?

The timeline for a roofing insurance claim in Houston can vary based on several factors. Generally, the process can take anywhere from a few weeks to a few months. Initial acknowledgments by the insurance company usually occur promptly, but the subsequent steps, including inspections, estimate reviews, and final settlements, can extend the timeline. Factors such as the severity of roof damage, the volume of claims being processed due to widespread weather events, and the clarity of submitted documentation all influence the duration. To expedite the process, maintain open communication with your insurer and ensure all required documents and evidence are provided promptly and thoroughly.

Need roofing insurance claim in Houston, TX? Call Klein Roofing at (888) 828-5630 or send us a message online today!